Maximizing Business Growth: Denver’s Guide to Inventory, Equipment & Accounts Receivable Financing with Acquisition Loans

In the dynamic Denver business scene, effectively managing Inventory, Equipment, and Accounts Receiv…….

In the dynamic Denver business scene, effectively managing Inventory, Equipment, and Accounts Receivable (IEAR) is crucial for securing a competitive edge through a business acquisition loan. IEAR financing provides working capital to acquire resources vital for growth, optimizing cash flow and operations. Businesses aiming to expand through acquisitions in Denver benefit from flexible, swift loan options that enhance competitiveness without asset sacrifice. To secure these loans, careful financial record management, robust cash flow demonstrations, and open communication with lenders are essential.

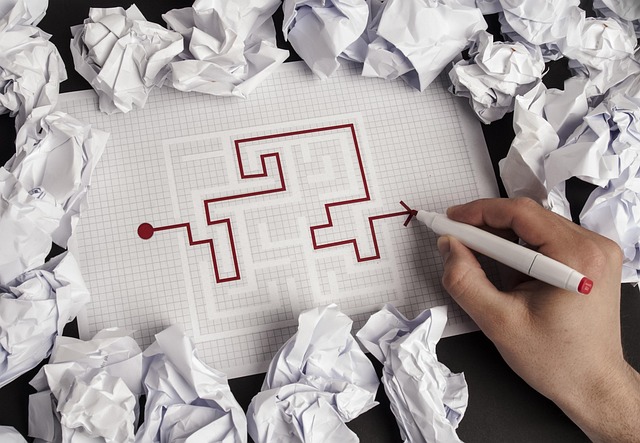

“Unleash your business potential with strategic financing solutions, particularly focusing on inventory, equipment, and accounts receivable management. In this comprehensive guide, we explore how a Business Acquisition Loan in Denver can revolutionize your operations. From optimizing stock to securing top-tier equipment, these loans offer unparalleled benefits.

We’ll navigate the process, providing tips for a seamless experience. Discover how efficient financing practices can drive growth, enhance cash flow, and solidify your business’s financial future.”

- Understanding Inventory, Equipment, and Accounts Receivable Financing

- Benefits of Using a Business Acquisition Loan in Denver

- Navigating the Process: Tips for Effective Financing

Understanding Inventory, Equipment, and Accounts Receivable Financing

In the dynamic landscape of business financing, understanding Inventory, Equipment, and Accounts Receivable (IEAR) is crucial for businesses looking to optimize their financial strategies. IEAR financing plays a pivotal role in supporting business acquisition loans in Denver and beyond. Inventory represents the goods available for sale, while equipment encompasses machinery and tools essential for production. Efficient management of these assets is key to maintaining cash flow, as it ensures that funds are allocated effectively to meet operational needs and growth aspirations.

Accounts Receivable, on the other hand, refers to the money owed by customers for goods or services already delivered. Effective IEAR financing strategies enable businesses to transform this receivable debt into immediate capital, facilitating smooth operations and fueling expansion plans. In the context of a business acquisition loan in Denver, a solid understanding of these financial components can significantly enhance loan applications, ensuring access to funding that drives success in today’s competitive market.

Benefits of Using a Business Acquisition Loan in Denver

In Denver, businesses looking to expand their operations often turn to a business acquisition loan as a strategic financing option. This type of loan offers several advantages for companies aiming to purchase inventory, equipment, or accounts receivable. One significant benefit is its flexibility; these loans are tailored to meet the unique needs of various industries, allowing businesses to access working capital without sacrificing assets. This funding can be particularly valuable for small and medium-sized enterprises (SMEs) seeking to capitalize on growth opportunities.

Additionally, a business acquisition loan in Denver provides a quick and efficient solution for financing significant purchases. Unlike traditional loans with lengthy approval processes, these loans streamline the borrowing experience, enabling businesses to secure funds promptly. This prompt access to capital ensures that companies can seize market opportunities, invest in modern equipment, or manage cash flow during peak demand, ultimately contributing to their long-term success and competitiveness in the Denver market.

Navigating the Process: Tips for Effective Financing

Navigating the process of inventory, equipment, and accounts receivable financing can be a complex task for any business owner. However, with careful planning and strategic moves, securing funding for these critical assets becomes more manageable. For those seeking a business acquisition loan in Denver, understanding the nuances of this financing path is essential.

One key tip is to organize and present accurate financial records. Lenders in Denver will want to see detailed inventory lists, equipment valuations, and historical accounts receivable data. Keeping meticulous records allows for a smoother application process and increases the chances of securing favorable loan terms. Additionally, businesses should be prepared to demonstrate their cash flow management capabilities and provide evidence of a solid repayment plan. Effective communication with lenders about specific financing needs and goals can also lead to tailored solutions, ensuring a successful business acquisition loan journey in Denver.

Business acquisition loans in Denver can be a strategic financial tool for businesses looking to optimize their inventory, equipment, and accounts receivable. By understanding these financing options and the benefits they offer, business owners can make informed decisions to enhance their operational efficiency and overall growth. When navigating the process, it’s crucial to follow effective tips, ensuring a smooth journey towards securing the right loan for your Denver-based business needs.