Denver Market Expertise: Strategies for Business Acquisition Loans

Denver's dynamic economy, characterized by established industries and burgeoning tech hubs, pre…….

Denver's dynamic economy, characterized by established industries and burgeoning tech hubs, presents significant investment opportunities, especially through business acquisition loans. Local expertise is crucial for navigating the competitive landscape and identifying prime locations. Entrepreneurs should build relationships with specialized lenders, present comprehensive business plans, and seek pre-approval to secure financing. Successful business acquisitions in Denver serve as case studies, demonstrating the region's robust economy and access to funding options, such as business acquisition loans, which have fueled regional growth and expansion.

“Unleashing the Potential of Local Expertise in the Denver Market

In the competitive landscape of business acquisition, understanding local nuances can be a game-changer. This article delves into the unique characteristics and opportunities that define the Denver market, highlighting the pivotal role of local expertise in securing successful business acquisition loans.

From navigating complex financing strategies to real-world case studies, we provide insights from Denver’s business leaders. Discover how their proven tips can guide entrepreneurs through the process, ensuring a strong foundation for thriving businesses within this dynamic market.”

- Understanding the Denver Market: Unique Characteristics and Opportunities

- The Role of Local Expertise in Navigating Business Acquisition Loans

- Strategies for Securing Financing: Tips from Denver's Business Leaders

- Case Studies: Successful Business Acquisitions in the Denver Market

Understanding the Denver Market: Unique Characteristics and Opportunities

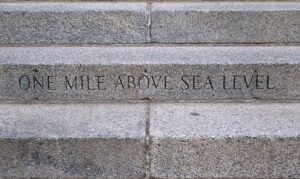

The Denver market stands out for its dynamic mix of established industries and emerging tech hubs, creating a unique environment for businesses. This vibrant city attracts professionals from across the globe, fostering a diverse and innovative workforce that drives economic growth. The real estate sector is particularly robust, with a steady demand for both commercial and residential spaces, presenting significant opportunities for investment and development.

When considering a business acquisition loan in Denver, understanding these market dynamics is crucial. Local expertise can help navigate the competitive landscape by identifying prime locations for expansion or investment. The city’s strong economic foundations and favorable business climate make it an attractive destination for entrepreneurs and investors alike. This, coupled with efficient financial solutions tailored to the Denver market, enables businesses to thrive in this rapidly evolving urban center.

The Role of Local Expertise in Navigating Business Acquisition Loans

Navigating the complex landscape of business acquisition loans in Denver requires a deep understanding of the local market and financial nuances. Local expertise plays a pivotal role in this process, acting as a compass for entrepreneurs and businesses seeking to expand or transition. The knowledge held by seasoned professionals who specialize in business acquisition loans can guide clients through the intricate web of regulations, interest rates, and terms specific to Denver’s economic environment.

This local insight is invaluable when securing financing for significant business transactions. Lenders with an in-depth grasp of the Denver market can help businesses identify suitable loan options tailored to their unique needs. They stay abreast of evolving trends, such as changes in property values or emerging industries, which can impact loan eligibility and terms. This expertise ensures that businesses receive sound advice, enabling them to make informed decisions when pursuing a business acquisition loan in Denver.

Strategies for Securing Financing: Tips from Denver's Business Leaders

When it comes to securing financing for a business acquisition in the Denver market, local entrepreneurs and business leaders have shared their invaluable insights. One of the key strategies recommended is building strong relationships with lenders who understand the unique dynamics of the Denver economy. This often involves seeking out specialized financial institutions or experienced brokers who can guide you through the process and connect you with suitable loan options, including business acquisition loans tailored to the local market.

Additionally, these experts emphasize the importance of a comprehensive business plan that highlights your vision, growth strategies, and the potential for successful repayment. By demonstrating a solid understanding of your industry and Denver’s competitive landscape, lenders are more likely to be attracted to your proposal and offer favorable terms. Pre-approval for a loan before approaching potential sellers can also strengthen your position as a serious buyer in the competitive Denver market.

Case Studies: Successful Business Acquisitions in the Denver Market

The Denver market has witnessed several successful business acquisitions, which serve as compelling case studies for aspiring entrepreneurs and investors. These deals highlight the region’s vibrant economic landscape and the accessibility of financing options, particularly through business acquisition loans in Denver. Local businesses have leveraged these loans to fund expansions, buy out competitors, or diversify their portfolios, leading to increased market share and regional growth.

For instance, a recent case involves a tech startup that acquired its local rival using a strategically tailored business acquisition loan. The funding enabled the company to integrate operations, gain access to a larger customer base, and become a prominent player in Denver’s thriving tech hub. This strategic move not only boosted the acquired company’s prospects but also contributed to the overall competitiveness and innovation within the market.

The Denver market, with its unique blend of growth opportunities and competitive dynamics, demands a deep understanding for successful business acquisitions. Local expertise plays a pivotal role in navigating the complexities of a business acquisition loan in this thriving environment. By leveraging insights from seasoned professionals and implementing effective strategies, as highlighted in the case studies, businesses can unlock the full potential of the Denver market. When it comes to securing financing, these tips serve as valuable guidance for entrepreneurs aiming to thrive in this dynamic landscape, ensuring a smoother path to acquiring and growing their ventures.